Finance,

not fuss.

Your finance partner that goes beyond just compliance. No matter your industry, we proactively manage your finances to help you grow.

We treat you like a person

not a number.

We treat our clients like people, not just another number on a spreadsheet of tasks that need to be fulfilled. Our consultative approach allows us to not only help but you in a better financial position, but also better your understanding of your companies financials.

We work with a wide range of industries.

If you're building something, we’re the team to help you scale it sustainably.

It's time to

break up with your accountant.

We respond faster than most accountants, we’re proactive with advice, and we treat our clients like family. That means making sure your money is working its hardest, your setup is always efficient, and you’re never left in the dark. Our focus is on building long-term relationships where your success is our priority.

Our Services.

VAT returns are a statutory requirement for companies operating in the UK. They involve declaring taxable sales and purchases to HMRC with accurate records of supplies, customers, and expenses. Businesses should keep records of all their VAT-related transactions so that they can accurately report on them each quarter or year when submitting their returns. You must register if, by the end of any month, your total VAT taxable turnover for the last 12 months was over £85,000.

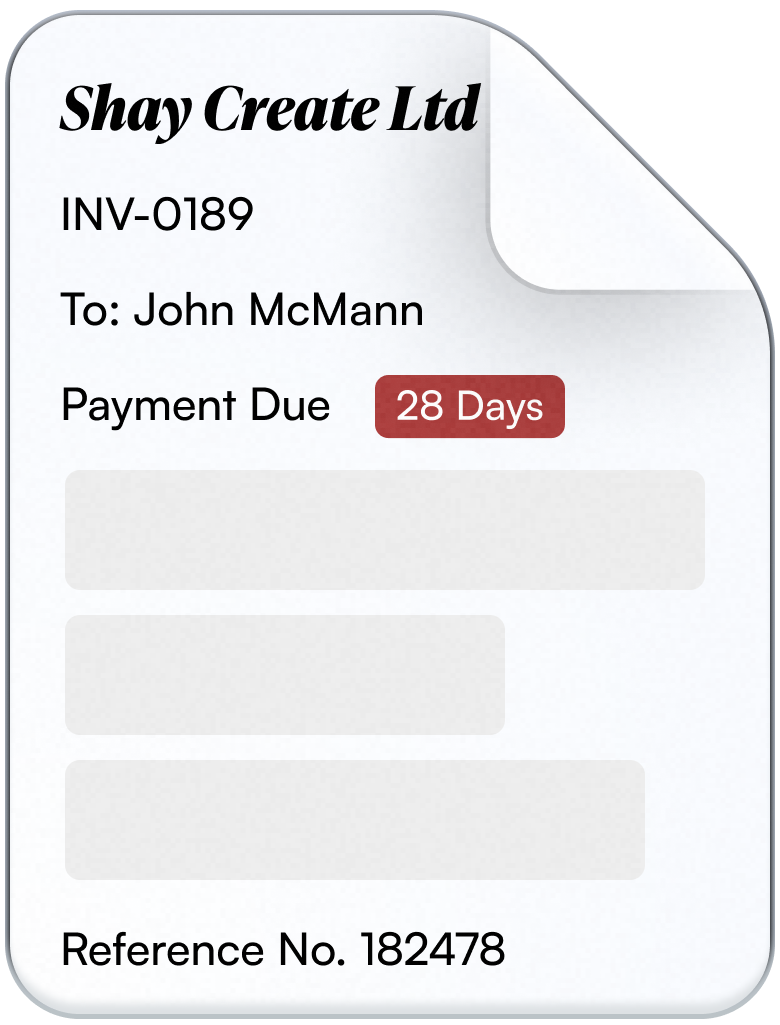

Invoicing for businesses is an important process that helps ensure timely payments. It is best practice to start invoicing immediately after a product or service has been provided. This way, the business can ensure they are paid in a timely manner and don't lose out on revenue due to late payments. Businesses should also consider the invoice terms they set with their customers. We can take all the stress and hassle away from you so you can focus on what you are good at.

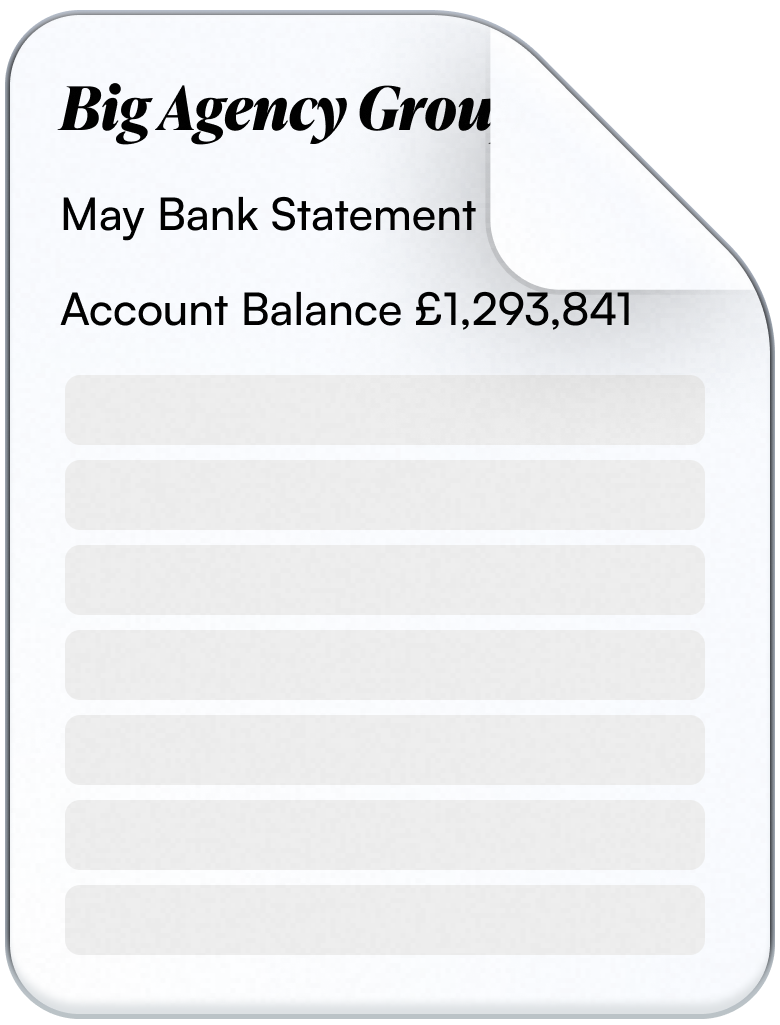

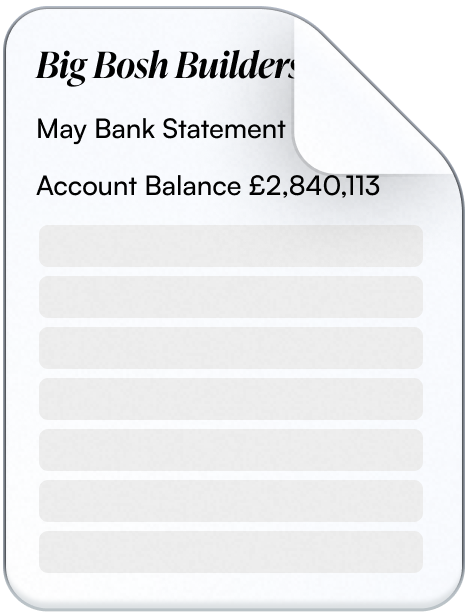

Annual accounts are a set of detailed financial statements that summarize a company's performance and financial position over the course of 12 months. These documents include key information such as the income statement, balance sheet, cash flows and more. They provide businesses with a better understanding of their finances and allow investors or lenders to gain insights into the company's performance. Overall, annual accounts help businesses track their performance and make informed decisions about their finances. By taking the time to review their annual accounts regularly, businesses can develop strategies for improving their bottom line while avoiding costly mistakes. At TSA, we are always reviewing clients accounts every month, because we have found that these monthly reviews helps clients make better financial decisions.

Read more

Bookkeeping is an important financial activity that involves recording and tracking transactions related to a business. This includes sales, purchases, returns and payments, as well as income and expenses. By keeping track of all these transactions, businesses can gain insight into their financial standing and develop strategies for improving profitability. We will maintain accurate records of a business' finances by inputting information into accounting software which will be directly linked to your business bank. We do this on a weekly basis ensuring books are always up to date. Overall, bookkeeping is an essential activity for businesses of all sizes that want to stay organized and successful financially. With the help of a professional bookkeeper, businesses can ensure that their finances are properly managed in order to maximize profitability over time.

Read more

Corporation tax returns are documents that must be filed with HMRC each year in order to calculate and pay taxes on income generated by a corporation within the United Kingdom. These returns include key financial information such as the company's profits, losses, deductions and other expenses for the fiscal year. The amount of corporation tax due will depend on the company's taxable profits for the year. Overall, it's important for businesses in the UK to accurately calculate and pay their corporation tax each year. By doing so, companies can ensure they remain compliant with governmental regulations while minimizing their overall tax liability. We will ensure you are compliant with all regulations as well saving you as much tax as possible

Read more

Self-assessment is a system used by HMRC to collect taxes from individuals and businesses on their income. This requires taxpayers to calculate and submit an accurate tax return each year which details their overall income, deductions, credits and other information necessary for calculating the amount of taxes due. In order to accurately complete a self-assessment tax return, individuals must first register with HMRC and obtain a unique 10 digit reference number known as UTR (Unique Taxpayer Reference). This reference will be used for any communications between HMRC and the taxpayer regarding tax payments or other matters. As long as we have the correct information, we can set this up for you and ensure the returns are filed in a timely manner.

The aim of credit control is to ensure that customers meet their obligations in a timely manner, while allowing companies to manage cash flow effectively. By taking steps to limit liability and improve cash flow, companies can ensure they remain compliant with local regulations while maximizing profits. We are experienced in understanding and interpreting financial data, which can help us identify potential areas of risk. At TSA we can help to set up effective debt collection strategies, such as setting realistic payment terms or using automated reminders. Additionally, we can monitor customer accounts for signs of financial stress and provide recommendations for debt recovery if needed.

Read more

Company incorporation UK allows companies to benefit from certain advantages such as limited liability, tax breaks and protection from personal creditors. Registering a company can be a complicated process for business owners unfamiliar with company law. Incorporating a company requires filing articles of association, appointing directors and shareholders, and providing information about the business’s capital structure.We can provide advice about appropriate capital structure and help to identify potential problems or areas of risk before they become a problem. We will be able to provide invaluable insight into what is required

Directors of limited companies are required to submit a director’s tax return form each year. We will need to provide details about the directors income from the company, including dividends received. Be assured whether your company has one director or ten, we will ensure each director is compliant with HMRC regulations.

TSA will be able to provide advice on how best to manage payroll in a way that complies with HMRC requirements. We help businesses to save time, money and hassle when it comes to dealing with payroll processes. We help ensure that the process goes smoothly and with minimal delays.

Read moreYour Internal

Accountant.

As a fractional accountant, I offer clients the flexibility of expert financial services without the commitment of a full-time hire. This approach allows businesses to access high-quality accounting support on an as-needed basis, tailored to their specific needs and budget.

.webp)

Join TSA

Ready to finally understand the finances of your business? Our consultative approach means you know exactly what you make, what you owe, and how to invest your money. So tell us a bit about yourself to get the ball rolling.